If you’re a freelancer or a small business owner in South Africa, chances are you’ll need to create invoices for your business. Download a free invoice template for your specific needs, and create and send professional invoices as a PDF, in Excel or as Google sheets, or in Microsoft Word or Google docs.

Get tips on what to include according to what you do and how to use professional Invoicing Software to get paid faster through online payments or credit cards.

Most small businesses need an invoice that stands out. Fill in, customise, and send out your small business invoices to your clients with our free invoice templates. Also find useful tips about what to include, how much to charge, and more.

Working as a freelancer means you’ll have to stay organised and implement a professional invoicing process that works for you and your clients. Download a free invoice template in word and learn what to include, how much to charge, and when to send invoices to your clients in South Africa.

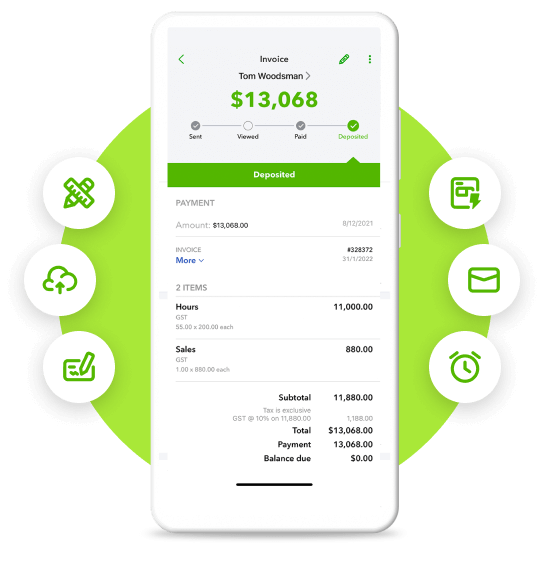

Looking to up your invoice game? With QuickBooks Online invoicing software you can send customised, professional invoices from your phone or computer in just a couple of minutes. Smart predictions make it easy to know when your invoices will be paid, you can even automate gentle reminders for overdue invoices.

| Invoicing Features | QuickBooks Online | Free Invoice Template |

| Email your invoice to clients for free | ||

| Add multiple lines of items with descriptions | ||

| Easily track who's paid and which invoices are outstanding | ||

| Avoid late payments with automated payment reminders | ||

| Set up deposit notifications to your mobile | ||

| Add a discount to your invoice | ||

| Automate invoices for recurring subscriptions | ||

| Create partial invoices for stages of a project | ||

| Create custom, personalised invoice templates | ||

| Create and send invoices from mobile devices on the go | ||

| Integrate invoice management with the rest of your business | ||

| Free unlimited support | ||

| Try Free for 30 Days | Download Now |

The South African government has strict criteria for invoicing clients. If your annual turnover exceeds or is likely to exceed R1 million, you must register for VAT and collect it on your invoices.

If your turnover in the past 12-month period has exceeded R50,000, you can choose to register for VAT voluntarily. However, if your business is registered for the turnover tax you don’t need to charge VAT on your invoices.

For local currency invoices, include:

You can read more about tax invoice requirements in South Africa on the South African Revenue Service (SARS) website.